-

play_arrow

play_arrow

Erewash Sound Love Music - Love Erewash

-

play_arrow

play_arrow

Food waste bins delivered to every household - Councillor James Dawson Erewash Sound

Derbyshire County Council dismisses suggestions it pledged to cut council tax as it considers increase

today3 February 2026 6

Derbyshire County Council headquarters at County Hall in Matlock. Image from Eddie Bisknell.

By Jon Cooper – Local Democracy Reporting Service

Derbyshire County Council’s finance chief who is considering introducing a council tax increase over three years has dismissed suggestions that the Reform UK-led authority had previously pledged to cut council tax levels in its election campaign.

The Reform UK-controlled administration’s Cabinet resolved at a meeting on January 29th to recommend to the full council at a pending meeting plans to implement an increase of around 4.9per cent to its council tax precept for the 2026-27 financial year as part of budget plans.

A council report had also indicated that plans for an on-going 4.99 per cent increase to its share of residents’ council tax bills may be necessary as part of the council’s Mid Term Financial Plan between the three financial years of 2026-27 to 2030-31.

Following a question from opposition Conservative Group Leader, Cllr Alex Dale, on whether the Reform-led council now regrets making tax cuts such a prominent feature in its May 2025 election campaign, the Reform council’s Cabinet Member for Council Efficiency, Cllr John Lawson, said he was ‘quite proud’ of the campaign and he has ‘no regrets at all’.

Cllr Lawson said: “In the campaign that happened in April, I cannot remember, and I have spoken to hundreds of people, and I cannot remember anybody expecting us to reduce council tax and it is an inconvenient question to raise at this forum.”

He added that he believes that the campaign literature in question related to key leaders of the Reform Party, including Leader Nigel Farage, highlighting three national issues to cut taxes, to freeze immigration and stop the boats, and to scrap Net Zero while reducing energy bills.

Cllr Lawson said: “As a party we stand by that initiative to cut taxes where possible and we will continue to do that wherever we are given the levers of power.”

However, he added cutting council tax is not a proposition in the current climate claiming Government funding – based on an allocation announced in September – has previously been better, in real terms, especially for rural counties like Derbyshire after a new policy has been identified by the Labour Party.

The council claims it is facing ‘economic uncertainty’ and ‘significant cost and demand pressures’ after a period of high inflation and the cost-of-living crisis with continuing increased demand for council services particularly in respect of social care with Children’s Social Care and to a lesser extent in Adult Social Care with plans to try and sell and dispose of nine care homes.

Cllr Stephen Reed, Cabinet Member for Business, has also previously refuted claims that the new Reform UK administration had previously pledged to cut council tax levels and that it is now doing a u-turn due to a significant loss in funding and financial insecurity.

He said: “We never promised to cut council taxes. At no point have we ever made a promise to cut council taxes. What we did promise was to cut wasteful spending and cut taxes nationally.”

Cllr Reed also claims the Labour Government has told the council it needs to raise its council tax rate to the maximum allowed of 4.99 per cent and that the Government’s decision to increase employer national insurance contributions alongside an increase to the minimum wage is also ‘eating into the budget’ and ‘hurting all councils’.

He added that in real terms a 4.99 per cent council tax increase on a Band D property means £81.29 and a half-pence per year on a resident’s overall council tax bill so each one per cent increase equals £16.29 per year on a Band D property or £1.35 per month.

The council’s former Conservative administration before the May, 2025, election had claimed it was on track to achieve over £31m of savings by the end of the 2024-25 financial year with tough cutbacks to manage a previously forecast budget deficit of over £39m for the 2024-25 financial year while identifying £18.6m of further necessary budget savings for the 2025-26 financial year to set a balanced budget.

Despite the new Reform UK-controlled council – elected in May – forecasting in October a promising net overspend of just over £1.3m against a Revenue Budget for the 2025-26 financial year of over £770.5m after the first quarter, it has now revealed its ongoing strategy will need to involve necessary ‘new savings plans’ for the 2026-27 financial year.

The cash-strapped council is now considering setting its council tax rate at its maximum for the next three years and it is planning to introduce £22.4m worth of new savings with potential cutbacks expected across a number of areas to help meet a forecast £37.8 million shortfall and to balance its budget for the 2026-27 financial year.

Total spending for the council for the next year stands at £838m including reserves with a highlighted budget shortfall of more than £37m with plans for £22.4 million in savings in the 2026-27 financial year alongside plans to raise a substantial sum from council tax.

Budget proposals approved for 2025-26 already included significant savings requirements across all departments with the funding of only essential or unavoidable service pressures and a limited use of reserves and an increase in council tax, and the council has argued it is facing factors beyond its control including pay and price inflation and rising demand and costs for services, particularly in adult and children’s social care.

Council Leader, Cllr Alan Graves, has also blamed the council’s previous administration for exhausting the authority’s reserves to address a projected multi-million pound budget deficit which has left the current administration drawing on only £186,000 worth of reserves for the 2026-27 financial year.

The Reform council is also having to calculate what the Government’s financial funding settlement for the authority means for 2026-27 to 2028-29 and it is considering a new Fair Funding Review change which consolidates a large number of grants into core funding and seeks to rebase a council’s overall funding level against an assessment of its need for funding.

Derbyshire County Council’s new proposals aim to deliver £22.4m of savings in 2026-27 to support meeting the forecast budget funding shortfall and it says the remaining shortfall will be made up from £2.5m of savings with changes to the way the council operates and with £12.9m to be saved from corporate budgets.

The council’s ‘savings plans’ could see a review of fee rates for home care, the closure of Glossop household waste recycling centre, changes to the community support beds system in care homes to reduce costs, more technology to support adult social care, and a service redesign with a ‘transformation’ department to introduce greater efficiencies alongside the removal of long-term vacancies across corporate services.

A ‘transformation’ programme aims to save at least £19.2m and potentially up to £38.7m over a two-year period right up to the expected changes under Local Government Reorganisation, according to the council, which could see Derbyshire represented by either a new single or two new unitary authorities.

A council report, entitled Budget Savings Proposals 2026-27 to 2030-31 and Update to Medium Term Financial Plan, states that the future modelling contained within the MTFP assumes an ongoing 4.99per cent increase to council tax and it outlines that the authority will need to find an additional £66m in budget savings by the 2030-31 financial year.

Opposition Labour Group Leader, Cllr Anne Clarke, has accused the Reform administration of ‘breaking its promise’ to cut taxes and she argued that the only cuts residents are seeing is to their vital services like care homes and a waste tip.

She also argued that the Labour Government has announced a huge multi-year funding settlement for the county council of over £160m which she says is a rise of 22 per cent compared to just £31.9m under the Conservative Government.

But Cllr Graves claims this funding settlement is a ‘redistribution exercise, not a growth plan’ with money being moved away from rural counties like Derbyshire and redistributed to large cities and urban authority tiers while the county council continues to face a rising demand for Adult Social Care with higher rural area costs and unresolved SEND pressures.

Opposition Conservative Group Leader, Cllr Alex Dale, has accused the Reform administration of ’empty rhetoric’ based on previous promises to cut taxes and opposition Green Party Leader, Cllr Gez Kinsella, accused the Reform council of misleading Derbyshire residents.

Cllr Kinsella said that at the last election Reform’s leaflets said they would ‘cut your taxes’ and they criticised others who ‘keep raising your council tax’ and he accused Reform of misleading Derbyshire people.

Reform Cllr Stephen Reed has argued Reform had only promised to cut wasteful spending and cut taxes ‘nationally’ and he refutes claims the new Reform UK administration had previously pledged to cut council tax levels and that it is now doing a u-turn due to a significant loss in funding and financial insecurity.

Cllr Reed argued the council is having to consider the Government’s funding settlement and Fair Funding Review in the context of the financial pressures caused by the growing demands for children’s social care and adult social care.

Council Leader, Cllr Graves, has also blamed the Labour Government for increasing cost pressures on local authorities and for introducing an increase in employer national insurance contributions.

The Cabinet resolved to recommend to the full council its Revenue Budget Report 2026-27 including an increase in its share of residents’ council tax bills for 2026-27 for the 2026-27 financial year.

The report states the original calculation assumed a 4.99 per cent increase in council tax income as this is what the Government assumes in calculating the Core Spending Power for the council, however the council tax income has now been recalculated based on a 4.90 per cent increase.

It adds that in the context of budget pressures and other funding changes it is recommended that for 2026-27 the council increases basic council tax by 2.9 per cent and levies an Adult Social Care precept of 2 per cent giving a total increase of 4.9 per cent.

The Cabinet also resolved to approve its Reserve Position and Reserves Policy and to recommend its Capital Programme Approvals, Treasury Management and Capital Strategies for 2026-27.

Following consideration of the council’s budget-setting report by the Cabinet on January 29th, all budget matters including the planned council tax increase will be considered at a full council meeting by all the councillors on February 11th before any final decisions.

The overall council tax bill for Derbyshire residents includes an accumulation of numerous precepts determined by the county council and relevant local authorities including district or borough councils, parish or town councils and the police and fire authorities as part of their annual budget arrangements.

Written by: Ian Perry

Sponsors

ON AIR

SEARCH

CATEGORIES

RECENT POSTS

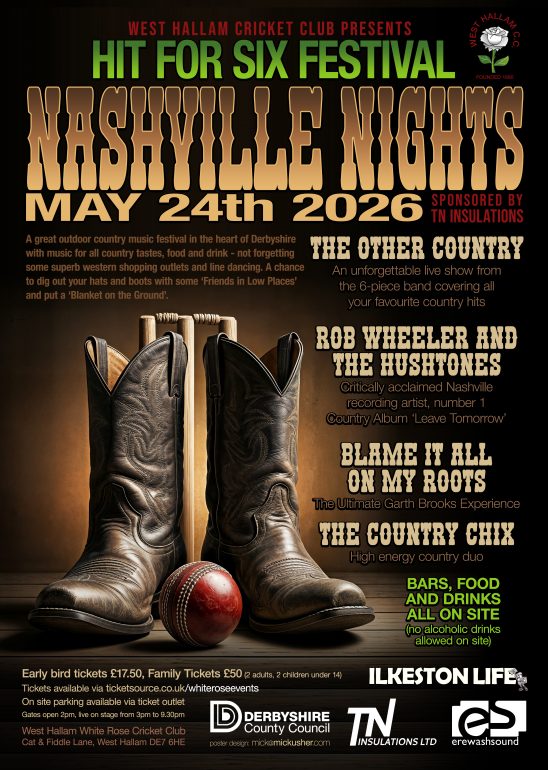

The Hit for Six Outdoor Festival – ‘Nashville Nights’ – Sunday 24th May with Erewash Sound

East Midlands universities join forces with EMCCA to drive regional growth

Appeal after motorcycle stolen from home before being found abandoned

Cats Protection launches short story competition (open until 31st March 2026)

Former Police and Crime Commissioner quits the Conservative Party

103.5 & 96.8 FM

LOVE MUSIC

LOVE EREWASH

Office: 0115 888 0968

Studio: 0115 930 3450

Erewash Sound, The Media Centre, 37 Vernon Street, Ilkeston, DE7 8PD

© Copyright 2026 Erewash Sound CIC. All Rights Reserved. Company Number 6658171.